Buying opportunities remain untapped in Fraser Valley real estate market

July 3, 2025

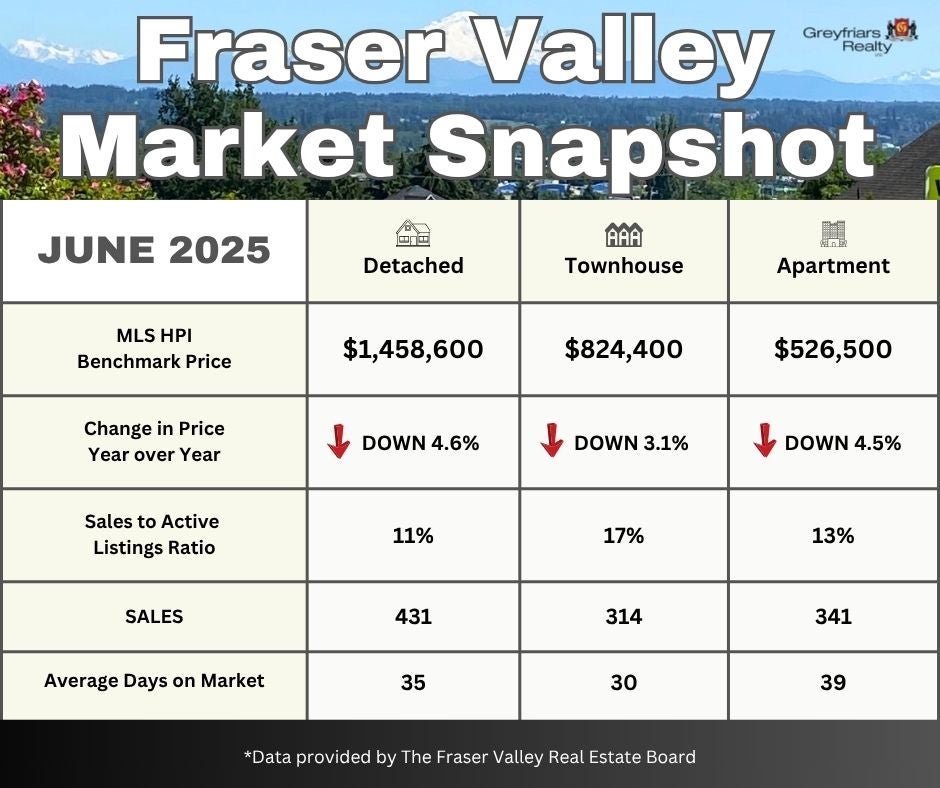

SURREY, BC — Economic uncertainty continued to be the main driver in buying decisions as home sales in the Fraser Valley remain mostly unchanged, despite abundant inventory and lower prices.

The Fraser Valley Real Estate Board recorded 1,195 sales on its Multiple Listing Service® (MLS®) in June, up one per cent from May, but nine per cent below sales from June 2024 and 33 per cent below the 10-year average.

The Fraser Valley remains in a buyer’s market with the supply of available homes continuing to build. Active listings approached 11,000 in June — a two per cent increase over May and 30 per cent above levels from this time last year. New listings declined 10 per cent over May to 3,618. The overall sales-to-active listings ratio is steady at 11 per cent; the market is considered balanced when the ratio is between 12 per cent and 20 per cent.

“For buyers who can tolerate the current economic uncertainty, this market offers some very real opportunities,” said Tore Jacobsen, Chair of the Fraser Valley Real Estate Board. “With more homes to choose from and softening prices, it’s a uniquely favourable time to make a move in the Fraser Valley, particularly for first-time buyers.”

Across the Fraser Valley in June, the average number of days to sell a condo was 39 days, while for a single family detached home it was 35 days. Townhomes took, on average, 30 days to sell.

“There’s no question the economy continues to grapple with unpredictability surrounding trade and tariffs, and the real estate market, like all sectors, is adapting to an uncertain future,” said Baldev Gill, CEO of the Fraser Valley Real Estate Board. “Perhaps this presents an opportunity for government to revisit policy decisions of the past, which may have served their purposes under different market conditions, in support of new economic realities.”

Across the Fraser Valley in June, the average number of days to sell a condo was 39 days, while for a single family detached home it was 35 days. Townhomes took, on average, 30 days to sell.

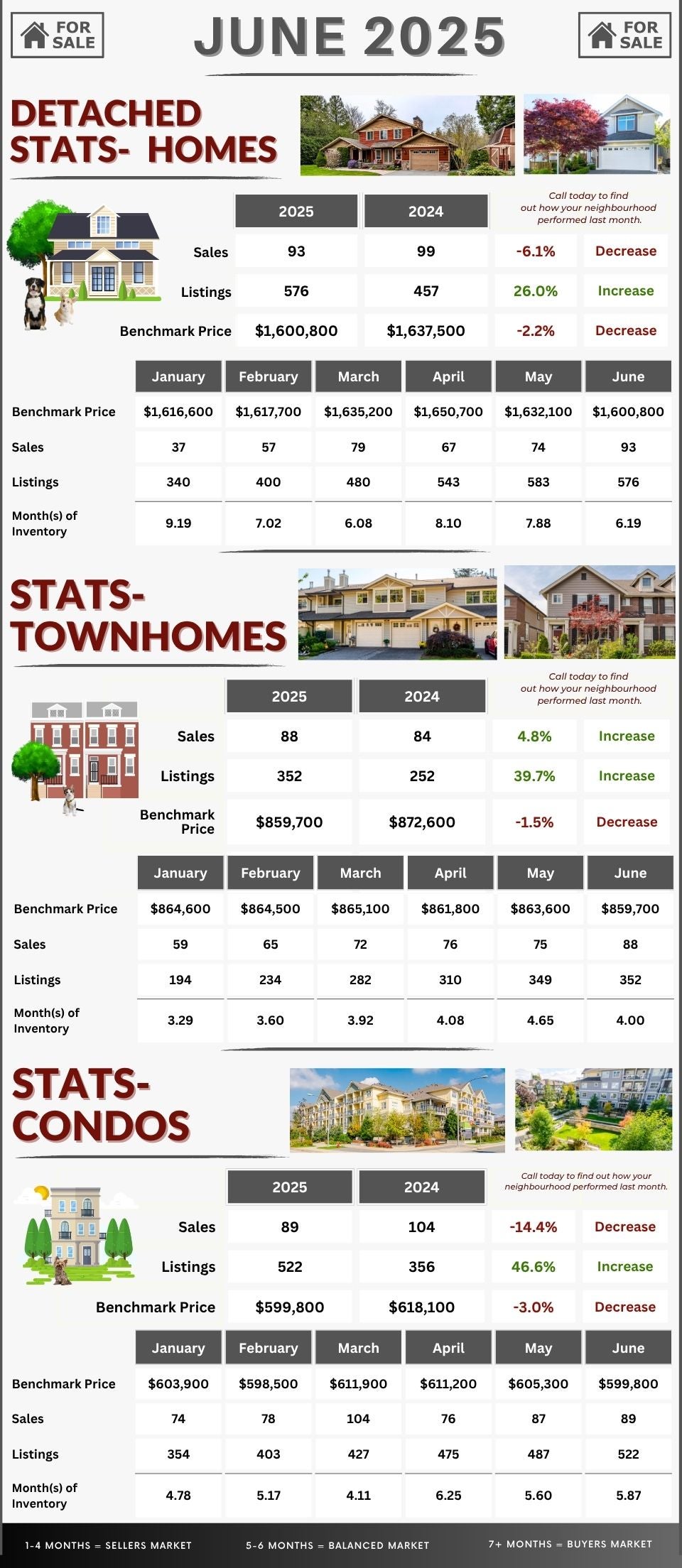

MLS® HPI Benchmark Price Activity

Detached Homes:

At $1,458,600, the Benchmark price for an FVREB single-family detached home decreased 1.6 per cent compared to May 2025 and decreased 4.6 per cent compared to June 2024.

Townhomes:

At $824,400 the Benchmark price for an FVREB townhome decreased 1.0 per cent compared to May 2025 and decreased 3.1 per cent compared to June 2024.

Apartments:

At $526,500 the Benchmark price for an FVREB apartment/condo decreased 1.2 per cent compared to May 2025 and decreased 4.5 per cent compared to June 2024.

To view the complete package:

Bidding War Battles: How To Come Out Victorious

It happens. Desirable home. Desirable neighbourhood. Multiple buyers with offers. It can be a recipe for a bidding war.

So, what do you do if you have your heart set on a home that other people want too?

• Show them the cash — According to a report by Redfin, cash offers were 4 times more likely to win a bidding war. Of course, when considering making a cash offer don’t drain your emergency fund, and weigh factors such as if there is a penalty to pay if you withdraw from a certain account..

• Get pre-approved — Next to cash, getting preapproved before you shop is the next best option. This way you know what you can afford, and it ups your chances of winning a bidding war because the seller knows you are serious and can close faster.

• Give your home’s exterior some love — Expect potential buyers to examine the exterior more closely in the warmer months. Ensure your patio furniture is clean and wash the windows inside and outside if possible. For balconies, planters of colourful flowers go a long way. If you have a yard, clear any debris from the winter, consider putting down some fresh mulch, and tend to landscaping.

• Offer over asking — In doing so, make sure you know the highest amount you are willing to offer, thinking in terms of what the monthly payment would be.

• Limit contingencies — Contingencies waived usually apply to inspections, appraisals, finances, and insurance. Be aware that waiving contingencies limits your ability to back out of the deal and you take a potentially serious financial risk.

Navigating a bidding war can be tricky, so you need to be prepared for one before it happens. As an experienced REALTOR®, that’s where I can help. If moving is on your mind, call or email me today for any questions you may have: 604-309-5453 or email: bonetti@telus.net

Navigating a bidding war can be tricky, so you need to be prepared for one before it happens. As an experienced REALTOR®, that’s where I can help. If moving is on your mind, call or email me today for any questions you may have: 604-309-5453 or email: bonetti@telus.net

Living in the Sky: Pros and Cons of Penthouses

Do you ever dream of living in style at the top of a building in a penthouse? If it’s something you think you might want to make a reality at some point, read on for some pros and cons to weigh before buying a penthouse

PROS—

•Panoramic views with lots of light

•Often has added features lower floors don’t, such as more square footage and higher ceilings

•Can be a great investment, especially if you buy a pre-construction when prices tend to be lower

•Because there is less supply, there is less market volatility

•Demand sustains itself because they are unique

•Usually, priced higher than lower-floor units

•Can be quieter because there is no upper-floor noise (unless the building has rooftop amenities) and it is further from street noise

•Typically, is more private than the rest of the building

CONS —

CONS —

•More expensive to buy and maintain (the greater the square footage the higher the maintenance fees)

•Greater exposure to the elements (e.g., storm damage to the roof)

•You are liable for overflow of sinks, tubs, and washing machines, and need to account for having more floors below you to potentially damage. Check your insurance coverage to ensure it’s sufficient

•Depending on the height of the building, the elevator ride could be long with many stops along the way. If the elevators aren’t working, keep in mind that you will have to take the stairs

•Longer response time in case of emergencies

• If mechanical systems are on the roof, it could be noisy

Call or email today for any questions you may have: 604-309-5453 or email: bonetti@telus.net

Check out our next ad in the Langley Advance Times :

Recent Blog Entries

Top Floor- 2 Bed/2 Bath in Countryside Estates

(Jul 09, 2025)

Just Listed- 1750 sqft 2 Bed/2 Bath Upper END Unit in Chelsea Green

(Jun 26, 2025)

The Power of Scent in your HOME

(Jun 25, 2025)

REAL ESTATE NEWS

The Bank of Canada holds key interest rate at 2.75%

"With uncertainty about US tariffs still high... Governing Council decided to hold the policy rate as we gain more information on US trade policy and its impacts."

The Bank of Canada's next interest rate decision of the year comes on

July 30, 2025

Current Mortgage Rates in BC :

Fixed Rates

1-year

Fixed rate: 4.69% insured, 4.99% bank rate

3-year

Fixed rate: 3.84% insured, 3.99% bank rate

5-year

Fixed rate: 3.89% insured, 4.19% bank rate

Variable Rates

5-year

Variable rate: 3.95% insured, 4.30% bank rate

Prime Rate:

4.95%

Cues It’s Time to Downsize

If you are nearing retirement or you are already retired, you may be thinking about downsizing, as it can free up your finances and simplify your life, allowing you to enjoy a greater quality of life.

So, what are some cues that it's time to downsize?

- You are having frequent falls or trouble navigating the stairs. If this is the case, you may be safer in a single-story home or a condo with elevators.

- You are overwhelmed with home maintenance.

- Your housing costs have risen above 30 percent a month.

- You want to free up your home equity, perhaps so you have more disposable income for things like travel.

- The home no longer fits your needs.

- There are unused rooms and amenities.

- Your career and family no longer tie you to the area.

- You want to be closer to your family.

- The demographics in your neighbourhood have changed and you no longer have a sense of belonging there. Perhaps a retirement community would make more sense, so you can make new friends and enjoy activities together.

While it can be hard to let go of a home that holds so many memories, letting go means you will create space for new possibilities.

How to Choose a Real Estate Lawyer

When buying and selling real estate, besides a good REALTOR®, the person who helps protect your interests the most is a good real estate lawyer. So, what are the top qualities and traits of a good real estate lawyer?

Seasoned — 90 percent of their practice should be focused on real estate in your location.

A transparent fee structure — Are there hidden fees? Do their fees include title insurance? If not, research another lawyer.

Good online reviews — Also, ask for recommendations from your network.

Communication skills — Do they respond to you in a reasonable time frame? Do they explain things in a way that is easy to understand? Do they listen attentively to you?

Involvement — Ask how involved the lawyer will be since many lawyers work with assistants, and you want to be sure the lawyer will closely attend to your file.

So, before you hire a real estate lawyer, be sure to shop around. It could mean the difference between smooth sailing and a nightmare.

Get to Know...

Joanne Bonetti

Get to Know...

Joanne Bonetti

Joanne's formal education and training allows her to excel at every step of the real estate selling or buying process.

Joanne has always lived in the Langley area and is very knowledgeable of the Fraser Valley market.

Choosing a Real Estate Career over 15 years ago, she has seen the many changes this industry has had. Following the trends and staying informed is crucial to this business.

Outside of her career in real estate, Joanne enjoys an active lifestyle with crossfit, neighbourhood walks and spending time with family and friends.

Known by clients and colleagues for her honesty, dedication and reliability, Joanne also has a reputation for timely and focused responses to each of her client’s needs and concerns. She is a skilled negotiator and goes the extra mile for her clients. Always included is quality after-care from start to finish.

A Full-time Realtor who is committed to providing expertise tailored to your needs and learning what is important to you to reach your real estate goals, Joanne is a clear choice for anyone thinking of buying or selling their home.

A big Thank you to all her clients, friends, and family for their continued support.

Proud Supporter of the Canadian Cancer Foundation

The Power of Scent

•Light florals

•Light florals  •Strong cooking smells (fish, eggs, garlic, onion, etc.)

•Strong cooking smells (fish, eggs, garlic, onion, etc.)